It Will Rain – Bruno Mars Lyrics

It Will Rain – Bruno Mars About Artist: Bruno Mars Genres: R&B/Soul, Pop Awards: MTV Video Music Award Japan…

It Will Rain – Bruno Mars About Artist: Bruno Mars Genres: R&B/Soul, Pop Awards: MTV Video Music Award Japan…

Lush Life – Zara Larsson About Released: 2015 Album: Lush Life Artist: Zara Larsson Genres: R&B/Soul, Pop Nominations: Grammis Award for…

Love me harder – Ariana Grande and The Weeknd About Released: 2014 Album: My Everything Artists: Ariana Grande, The Weeknd…

Locked Away – R. City About Released: 2015 Album: The Dome, Vol. 75 Featured artist: Adam Levine Artist: R. City…

Locked Out of Heaven – Bruno Mars About Artist: Bruno Mars Awards: MTV Europe Music Award for Best…

We Are Young – fun feat Janelle Monáe About Released: 2012 Album: Some Nights Artist: fun. Featured artist: Janelle Monáe…

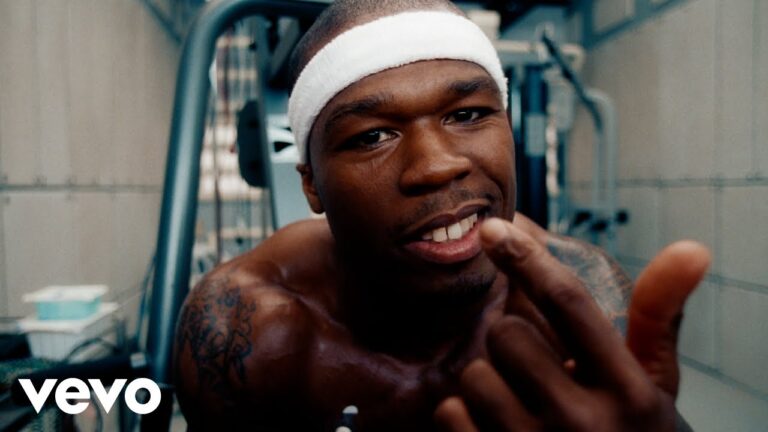

In da Club – 50 Cent About Released: 2003 Artist: 50 Cent Album: Get Rich or Die Tryin’ Genres: R&B/Soul,…

Style – Taylor Swift About Released: 2014 Album: 1989 Artist: Taylor Swift Style – Taylor Swift FAQ Q: What…

Man Down – Rihanna About Album: Loud Artist: Rihanna Awards: Soul Train Music Award for Best Caribbean Performance Genres: R&B/Soul,…

Marvin Gaye – Charlie Puth About Released: 2016 Album: Nine Track Mind Featured artist: Meghan Trainor Artist: Charlie Puth Genres: R&B/Soul,…